Bitcoin Surpasses $102,000 After Massive Drop Due to Fed’s Rate Cuts

Bitcoin Surpasses $102,000 After Massive Drop Due to Fed’s Rate Cuts

Bitcoin Surpasses $102,000 After Massive Drop Due to Fed’s Rate Cuts

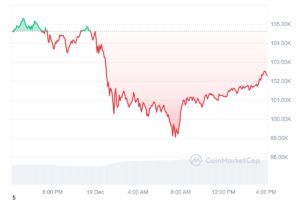

The cryptocurrency market has once again showcased its resilience, with Bitcoin (BTC) rebounding above $102,000 just days after a dramatic drop fueled by the Federal Reserve’s controversial announcement of upcoming rate cuts. This recovery highlights Bitcoin’s inherent volatility and its ability to regain momentum even in the face of adverse macroeconomic conditions.

The Initial Crash: Fed’s Rate Cut Impact

The Federal Reserve’s declaration of impending rate cuts sent shockwaves across financial markets, causing a massive sell-off in risk assets, including cryptocurrencies. As investors shifted their focus toward traditional, safer assets, Bitcoin’s price nosedived, falling below $100,000 for the first time in weeks. The sudden drop, over $8,000 in less than a day, resulted in significant panic within the market.

This was compounded by broader concerns about how reduced interest rates would affect speculative assets. Despite crypto’s growing mainstream adoption, its high-risk nature made it particularly susceptible to these macroeconomic pressures.

The Road to Recovery

However, Bitcoin has defied the odds, regaining strength and surpassing the $102,000 mark. Analysts attribute this bounce-back to several key factors:

1. Institutional Accumulation: Large-scale investors took advantage of the dip to accumulate Bitcoin at a discounted price, fueling renewed buying pressure.

2. Improved Market Sentiment: The cryptocurrency market is notorious for its swift sentiment shifts. News of Bitcoin’s bounce above $100,000 reignited optimism among retail investors and traders.

3. Decreasing Dollar Strength: A weakening U.S. dollar following the Fed’s announcements played a role in boosting Bitcoin’s value as an alternative store of value.

Altcoins Follow Bitcoin’s Lead

Bitcoin’s recovery has also benefited the altcoin market. Major tokens such as Ethereum (ETH), XRP, and AVAX have seen double-digit percentage increases in the past 24 hours. Altcoins, which typically move in tandem with Bitcoin, are now recovering from the substantial losses they incurred during the broader market crash.

What’s Next for Bitcoin?

Bitcoin’s climb above $102,000 has renewed bullish momentum, with many speculating about the potential for new all-time highs. However, market analysts remain cautious, emphasizing that external factors like Federal Reserve policies and regulatory developments will continue to impact Bitcoin’s price trajectory.

For investors, this recent rebound serves as both a reminder of Bitcoin’s volatility and its remarkable ability to recover. Long-term holders, in particular, have been rewarded for their patience, while traders are capitalizing on the wild price swings for short-term gains.

more insights

Will Bitcoin reach a new all-time high in 2025?

Will Bitcoin hit $100,000 Will Bitcoin hit New ATH in 2025? Bitcoin has always been a hot topic in the

Craig Wright to Prison: The Last Scene in the Bitcoin Drama?

Craig Wright, the controversial figure in the crypto world who claims to be Satoshi Nakamoto—the mysterious creator of Bitcoin, has

Bitcoin Price Drop’s: Causes and Impact on Investors

Bitcoin Price Volatility: What’s Driving the Swings? Bitcoin’s price has always been known for its volatility, but recent fluctuations have